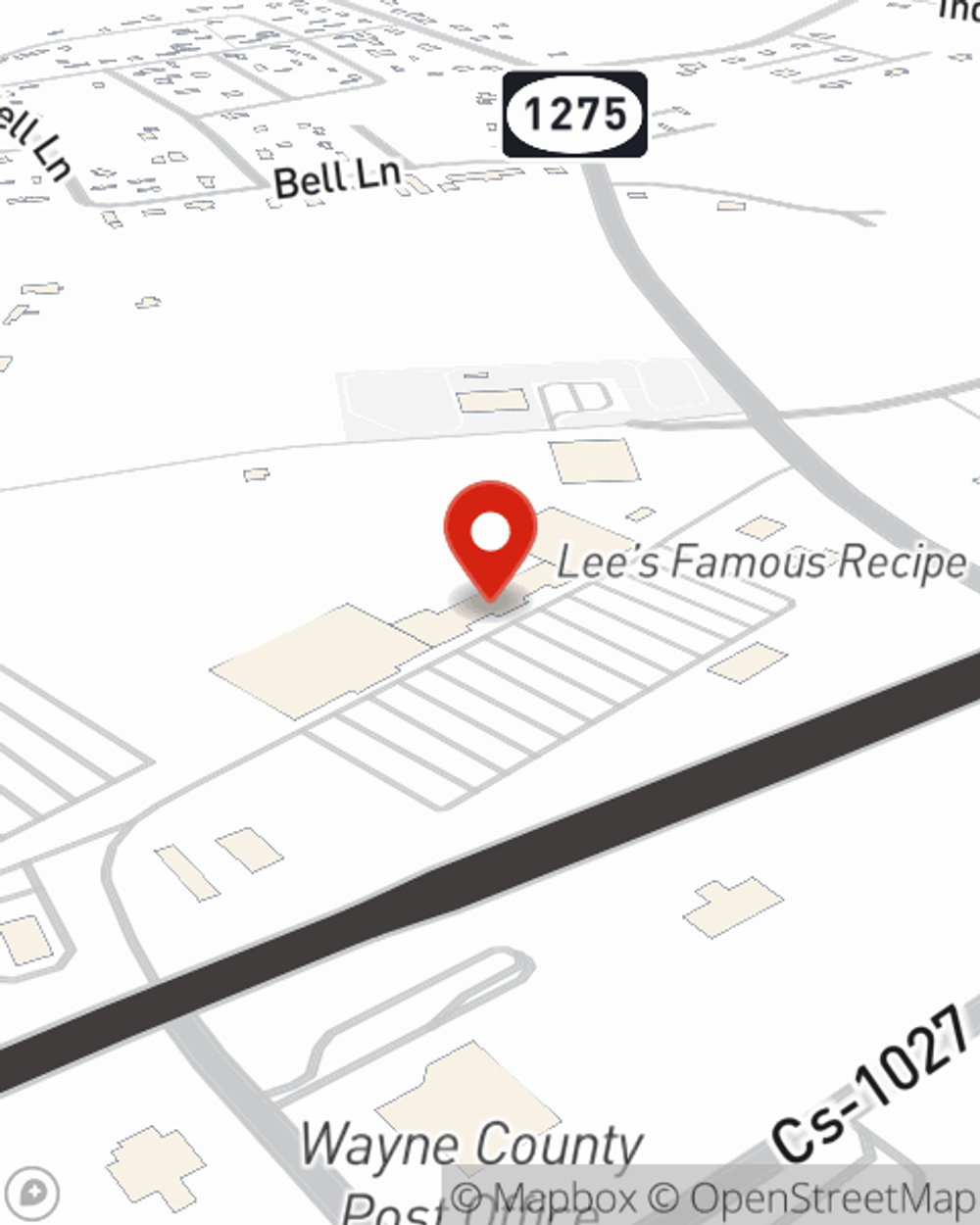

Business Insurance in and around Monticello

One of Monticello’s top choices for small business insurance.

Almost 100 years of helping small businesses

Help Prepare Your Business For The Unexpected.

Running a business is about more than surviving the daily grind. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for your family. Because you do whatever it takes to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with errors and omissions liability, a surety or fidelity bond and worker's compensation for your employees.

One of Monticello’s top choices for small business insurance.

Almost 100 years of helping small businesses

Protect Your Future With State Farm

Whether you own a dry cleaner, an ice cream shop or a farm supply store, State Farm is here to help. Aside from outstanding service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call Joe Farmer today, and let's get down to business.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Joe Farmer

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.